How much should you be contributing towards your pension?

Posted by siteadmin on Thursday 15th of June 2017.

As Financial Advisers the question we are asked the most is “How much should I be putting into my pension plan?” This is a difficult question to answer as it depends on so many variables such as, when you start your pension plan, the age at which you want to retire, how much you can afford per month and the investment growth over the years the plan will be invested.

Let’s assume you were retiring today at age 68 and you had set yourself the objective of receiving the National Average Retirement Income currently £27,000 per annum (p.a.). Let’s also assume you had paid all your National Insurance contributions so will be receiving the full state pension of £8,297.

As you can see to achieve your objective of an annual pension income of £27,000 p.a. you must have made up the shortfall of £18,703 p.a. To obtain this annual income shortfall of £18,703 p.a. you will have needed to create a fund of £360,000.

Here’s your task.

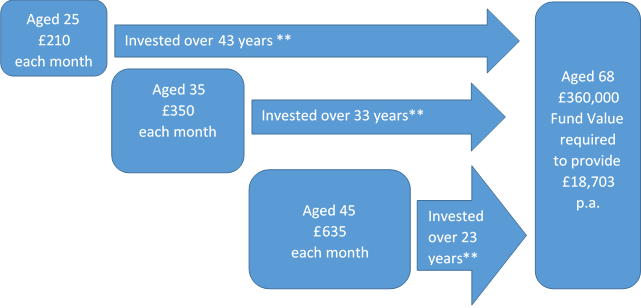

So, how much does one need to save per month from your disposable income to build up a fund of £360,000?

Well, it depends on some of those variables mentioned earlier. Here are some examples assuming that you retire at 68 which is the current expected retirement age for this age group.

Here’s the maths.

**All of the above are assuming an annual growth rate of 4% p.a.

Here’s the bonus.

The government will pay into your pension a 25% bonus on top of your contributions to make your task more affordable.

As you can see there is considerable difference between the monthly contributions you need to invest to meet the target. So the advice is the earlier you start your pension plan the more affordable the contribution will be throughout.

The information above is just a guide on how you could achieve an annual pension of £27,000 but it is up to you exactly what contributions you wish to make each month towards your pension pot to provide a suitable annual retirement income. Obviously, the more you contribute into your plan either monthly or lump sums, the bigger your eventual pension.

Click Here to enquire about your pension plan.

You are now departing from the regulatory site of Anglo International Group Limited. Anglo International Group Limited is not responsible for the accuracy of the information contained within the site.