Enhanced Annuities

Posted by siteadmin on Thursday 3rd of August 2017.

What are they and can you benefit?

You will want to ensure that you get the maximum income possible out of your pension pot when you retire.

It is therefore essential that you review all your pension pots now, to make best use of the up to date plans and funds available.

Bringing together all your pensions into one single plan allows you to concentrate on ensuring the best possible performance and most cost effective arrangement.

When you approach your retirement age, you will be faced with a decision, do you go for a guaranteed income for life by purchasing an annuity or do you go for the more flexible option offered by the new "Pensions Freedom."

Many people are, quite rightly, put off from considering purchasing an annuity because of the very low annuity rates which are currently available. At this time this is mainly due to the low interest rates. However, another major factor is that annuity rates are based on life expectancy. As we are all now living longer, this pushes the annuity rate down.

Did you know that just by confirming health and lifestyle information at retirement could mean you end up receiving a higher annuity rate and higher annual income for your retirement?

So … What is an annuity?

An annuity allows you to exchange some or all of your pension fund for a guaranteed taxable income for life from age 55 (57 in 2028). You can still take advantage of the first 25% of your pension fund as tax-free, either as lump sums or for tax-free income.

It’s hard to believe that if you have a medical condition that there is an investment option which works in your favour and can boost the amount of income you receive by as much as 50%. You can do this by taking out an enhanced annuity.

What is an enhanced annuity?

An enhanced annuity provides you with a higher income based on your health and lifestyle. As the enhancements can be significant and, because annuities are guaranteed to pay for life, it could mean thousands of pounds of additional income over your lifetime in retirement. Insurers consider that in view of your health and lifestyle they can offer a higher income over possibly a shorter period. Once it is set up it cannot be changed or cancelled.

There are over 1,500 medical and lifestyle conditions that are considered by annuity providers that could boost your retirement income by a significant amount.

How much more income is available to you?

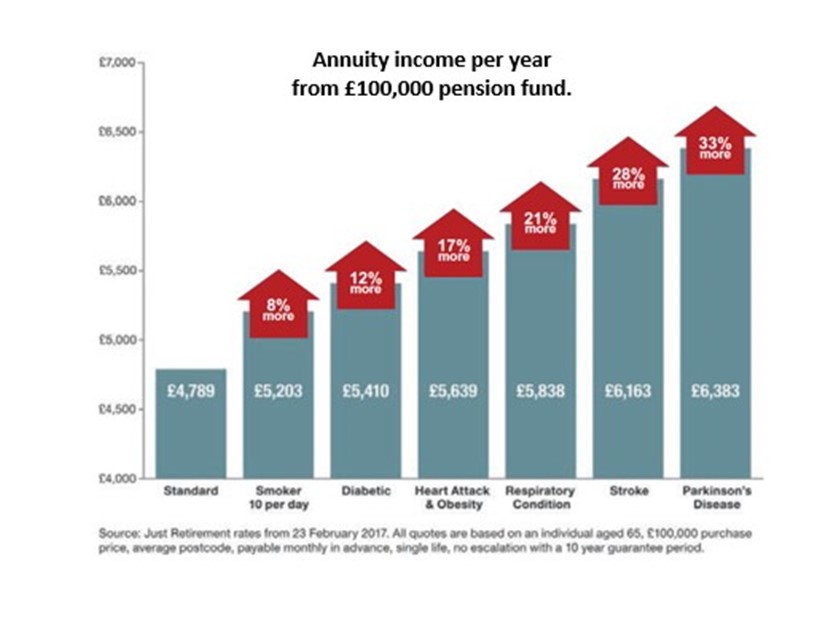

The graph below illustrates some of the conditions that would benefit from an enhanced annuity and the amounts that are available for these different conditions.

For independent pension advice please contact us either by clicking on Make Enquiry button above and selecting pensions or you can call us on our Freefone number 0800 193 1066.

You are now departing from the regulatory site of Anglo International Group Limited. Anglo International Group Limited is not responsible for the accuracy of the information contained within the site.