Are you due to retire in the next 40 years?

Posted by siteadmin on Monday 18th of June 2018.

Are you due to retire in the next 40 years?

I know this may seem a ludicrous thought when it is so far away. However, recent studies by King’s College London have shown that one in four retirees in the UK return to work usually within 5 years of retiring.

Whilst it is not always for financial reasons that people return to work; no one wants to have to return to work due to a lack of income. As Tennessee Williams said, “You can be young without money but you can’t be old without it.”

Here are six tips, which could ensure you do not run out of money in your retirement.

- START YOUR PENSION AS EARLY AS POSSIBLE.

The earlier you start investing money in your pension the more time it has to grow.

Pensions are the most tax-efficient way to invest for retirement, as the government automatically adds 25% to every pension contribution you make under the age of 75 (even if you do not pay tax). - INDEPENDENT ADVICE AND GUIDANCE.

Set up your pensions with the help and guidance of an Independent Financial Adviser (IFA). They have access to the whole pension and investment market and can recommend the best company and investments most suitable for you. - KEEP REVIEWING YOUR PLANS.

When you put money into a pension it is normally invested, so the better your investments perform the more your pension will grow. Review your pension with your adviser at least once a year and make adjustments to your pension investment funds to maximise their performance. - KNOW YOUR PENSION INCOME OPTIONS.

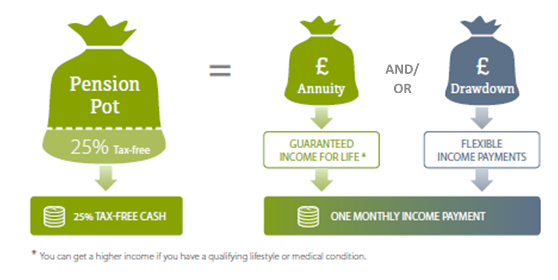

You can access your private pension from the age of 55 and 25% of your pension fund would be tax-free. The balance of your pension fund would be taken as income. Your income can be either on a guaranteed income basis through the purchase of an annuity or for more flexibility through the new Pension Freedom Drawdown plan. Alternatively, as a mixture of both.

- CHECK YOU ARE ON TRACK.

By using a pension calculator, you can work out whether you are on track to achieve the income you need to pay for the lifestyle you want in retirement. On website, we have a pension shortfall calculator. Click on this link to use it: https://www.angloifa.com/online-services/calculators/?title=Pensions+Shortfall+Calculator&id=6 - THE IMPORTANCE OF ONE PENSION POT.

If you have a number of pension plans of different employers or companies, seek the help of an IFA to bring all these plans together into one pension pot. This will ensure that you have the most cost effective pension plan with maximum flexibility on retirement.

If you would like independent financial advice please contact us either on our Freefone Number 0800 193 1066 or email us on info@angloifa.co.uk

You are now departing from the regulatory site of Anglo International Group Limited. Anglo International Group Limited is not responsible for the accuracy of the information contained within the site.