Is buying a buy-to-let still a good investment?

Posted by siteadmin on Monday 29th of January 2018.

Is buying a buy-to-let still a good investment?

For more than 10 years, UK investors have had a love affair with buy-to-lets. Soaring house prices, easy credit and high yields have all contributed to this “Golden Age of buy-to-let Investment” to such an extent that according to HMRC there are now 1.75 million landlords in the UK.

This affair may sadly be coming to an end. Certainly recent surveys and indications seem to suggest this to be the case. A recent survey by UK Finance found that 20% of buy-to-let landlords will leave the market within 5 years but more worryingly a recent poll by AXA, the large insurer, found that almost half will leave the buy-to-let market by 2020.

Unless one is buying a new buy-to-let property outright with cash, the cost of buying with a mortgage has become more difficult and certainly more expensive. So what’s changed to make this important financial market so expensive?

Here are the recent downsides affecting the buy-to-let market.

- 3% Extra Stamp Duty.

Since April 2016 all new buy-to-let purchases have incurred a 3% extra surcharge on the stamp duty.

- Tougher mortgage requirements.

Since 1st January 2017 all mortgage lenders have toughened up their mortgage criteria and requirements resulting from the Bank of England directive demanding that lenders set higher rental income requirements than previously.

- Applies to all portfolio properties.

Since 1st October 2017 landlords with four of more properties will have to pass the tougher lenders requirements on all their properties even though they are seeking a mortgage on only one property.

- Loss of tax relief on mortgage interest.

Since April 2017 for landlords owning property in their own names, the amount of tax relief available on the buy-to-let mortgage interest falls from 100% of the interest to 75% and then yearly to zero by 2020. This will then be replaced by a 20% tax credit, which will be disadvantageous to higher rate tax payers.

- Properties must be energy efficient.

It is estimated that up to 300,000 buy-to-let properties are rated an “F” or “G” and will require upgrading to meet new energy efficiency requirements by April 2018. Landlords who fail to meet the target risk being fined £5,000 per property. It is estimated that the additional cost to meet the minimum “E” rating is around £2,500. However, by 2030 the Government’s Clean Growth Strategy aims to upgrade every home to a “C” rating. Alarmingly, only 26% of privately rented homes currently satisfy this requirement, so more future costs for landlords coming down the line.

- Reduced yields.

Taking all these negatives together has put a damper on the buy-to-let market, especially in those areas where the yield has always been lower, like London and the South East region (yielding only around 4.5% p.a.). This is because property prices are so high compared to incomes and what renters can afford as rent.

Besides all these extra costs and requirements that now affect the buy-to-let investment, it is of course important to consider the capital growth on the property value but also the rental income return on the investment. Both of these factors are important when considering buy-to-let compared to other forms of investments.

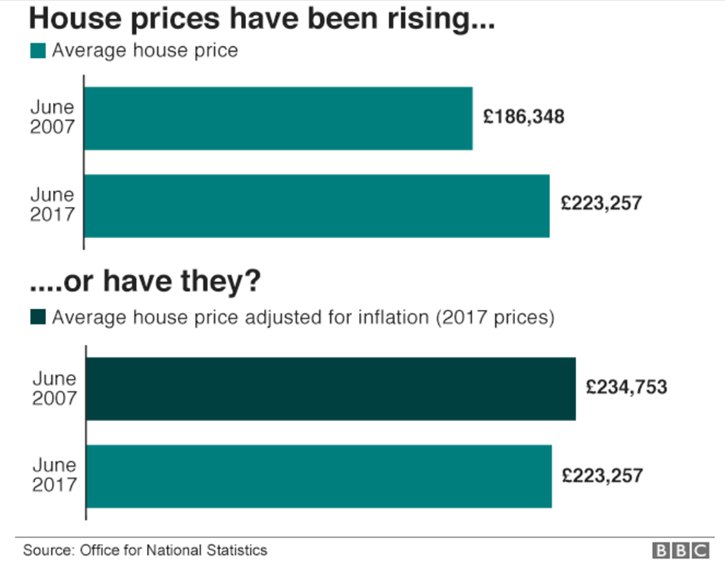

House prices are rising…or are they?

The price of the average UK home has risen in the past 10 years, as you would expect. Unfortunately, inflation has increased faster therefore; the average UK house price has fallen compared with a decade ago.

Certainly buying a buy-to-let property is not as attractive as it was, especially for those either approaching or in retirement and looking for an investment to provide income. The alternative forms of investment such as unit trust portfolios or ISA portfolios are certainly more attractive, in that they can provide excellent capital growth and an income which is tax free. The recent Pension Freedoms has resulted in the development of pension plans, which are now extremely flexible and certainly a lot less troublesome than buy-to-let properties but more importantly far more cost effective and good income providers.

If you would like independent financial advice on investments for capital growth or to produce an income, please contact us on our Freefone number 0800 193 1066 or click on the investments query button.

You are now departing from the regulatory site of Anglo International Group Limited. Anglo International Group Limited is not responsible for the accuracy of the information contained within the site.